- Global Energy Storage Closes Its First Investment in the Port of Rotterdam With Gunvor Group

- VARO Energy And GPS Group Announce The Completion Of An Integrated Biofuels Facility In The Port of Amsterdam

- Wellesley Petroleum AS Awarded New Licences

- Jernbro Industrial Services Acquires GISAB (Gällivare Industriservice AB)

- Digital Hard-Hitter Joins 3t Energy Group Board

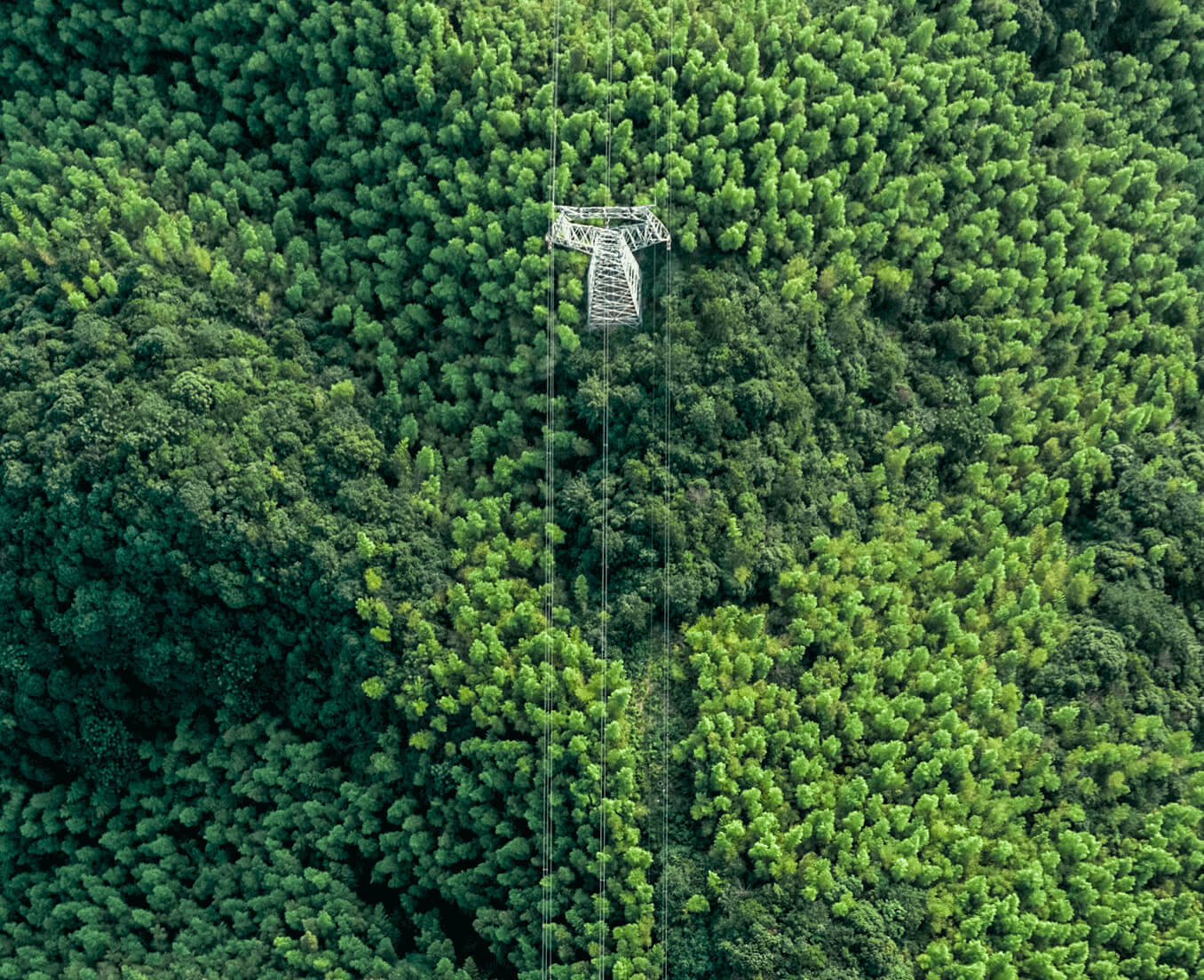

Responsible Investing

We have developed a focused ESG strategy that reaches into all areas of our operations: both within our business and across our portfolio companies.

The strategy is underpinned by a long-term roadmap that tracks how – through a variety of projects and initiatives – we can meet our ESG objectives.

Download the report

Energy Transition: New Momentum, New Responsibilities

Energy transition is broadly defined as the shift from the traditional use of fossil fuels to an industry in which the focus is upon applying new technologies to enhance the sustainability and efficient use of all energy types.

“The principles of ESG are central to our strategic thinking and everyday engagement with our portfolio companies”

Graeme Sword

Founding Partner

Bluewater believes that Responsible Investment is core to our firm’s ambition: to build world-class energy companies.

We recognise that ESG can influence long-term company value and that it is in the best interest of our investors to incorporate ESG into our investment analysis, decision-making and portfolio company engagement processes.

Signing up

for Sustainability

During 2020 Bluewater became an official signatory to the UN Principles for Responsible Investment (PRI).

It confirms our commitment to Responsible Investment as a strategy and practice, and to incorporate ESG factors into our investment decisions and active ownership. In doing so, we join over 3,000 other international signatories representing $103.4 trillion assets under management.

Case Study

ESG in action: The transformative approach of Galileo and Edge LNG

Around the world, natural gas is routinely flared as a by-product of oil extraction.

The gas itself is a valuable fuel, but the economic equation is such that it is not viable to invest in gathering capacity to take it to market, leaving only the options of burning it off or shutting down operations entirely. Taken at a global scale, this is an economic and environmental tragedy.

A technology-led solution

In 2016, Bluewater invested in Argentinian engineering and technology company, Galileo Technologies (Galileo). Galileo had pioneered a fully mobile LNG solution to make the most of its country’s remote and stranded gas assets.

The twin imperatives of increased demand for fossil fuels and emissions reduction may appear irreconcilable at first glance, but the reality is very different. In fact, those companies which can bridge the apparent gap will be some of the most valuable leaders as we navigate the energy transition.

With Edge LNG, operators finally have an economic solution to flaring. In fact, natural gas can become an additional revenue stream.

Read the full case study:

Download the reportSupporting Good Causes

Bluewater supports and encourages portfolio company partnerships with charities, serving to create long-term relationships that realise lasting change.

Charity WorkBluewater enjoys successful relationships with charitable organisations and has over the years supported numerous good causes.

These include Greenhouse Sports, a London-based charity which uses sport to engage young people and improve their life chances, and Moorfield Eye Charity, which supports the pioneering work of Moorfields Eye Hospital NHS Foundation Trust.

At the outset of the COVID-19 outbreak Bluewater made some additional charitable donations where our support could have an immediate impact.